Last Updated on June 24, 2025 by Bertrand Clarke

|

Exchange

|

||||||

|

Rating

|

Winner

Very good (5,0)

|

Good (4,8)

|

Good (4,6)

|

Good (4,4)

|

Good (4,2)

|

Good (4,0)

|

|

Fees

|

0,15%

|

0,10%

|

0,99%

|

1,5%

|

1%

|

1%

|

|

Cost per $1,000

|

$1,50

|

$1

|

$9,90

|

$14,90

|

$10,00

|

$10,00

|

|

Cost per $100,000

|

$150

|

$100

|

$990

|

$1,500

|

$1,000

|

$1,000

|

|

Fully licensed

|

|

|

|

|

|

|

|

Security

|

|

|

|

|

|

|

|

Details

|

Trusted by BlackRock

|

Super low fees

|

Big portfolio

|

Secure but expansive

|

Variety of Memecoins

|

Fast verification

|

|

Link

|

Buy Sui on Coinbase

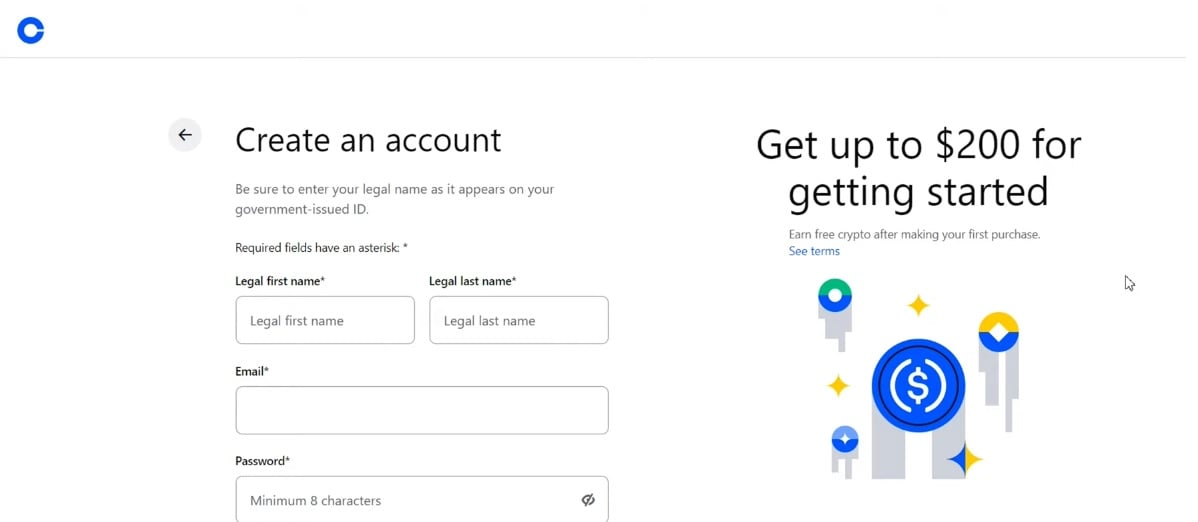

Essential Facts About Coinbase

Coinbase stands as a highly recognized international platform for buying and trading digital assets, operating under strict regulatory standards globally. In the United States, Coinbase possesses licenses for money transfers in nearly all states, including a BitLicense for New York, and is listed with FinCEN. Internationally, it holds key licenses in the UK and Germany.

Coinbase places a high priority on safeguarding customer assets, keeping approximately 98% of client holdings offline in secure cold storage to mitigate cyber risks.

The identity verification procedure is usually completed within 24–48 hours, though it may take longer during peak activity. Customers must submit valid ID and proof of address.

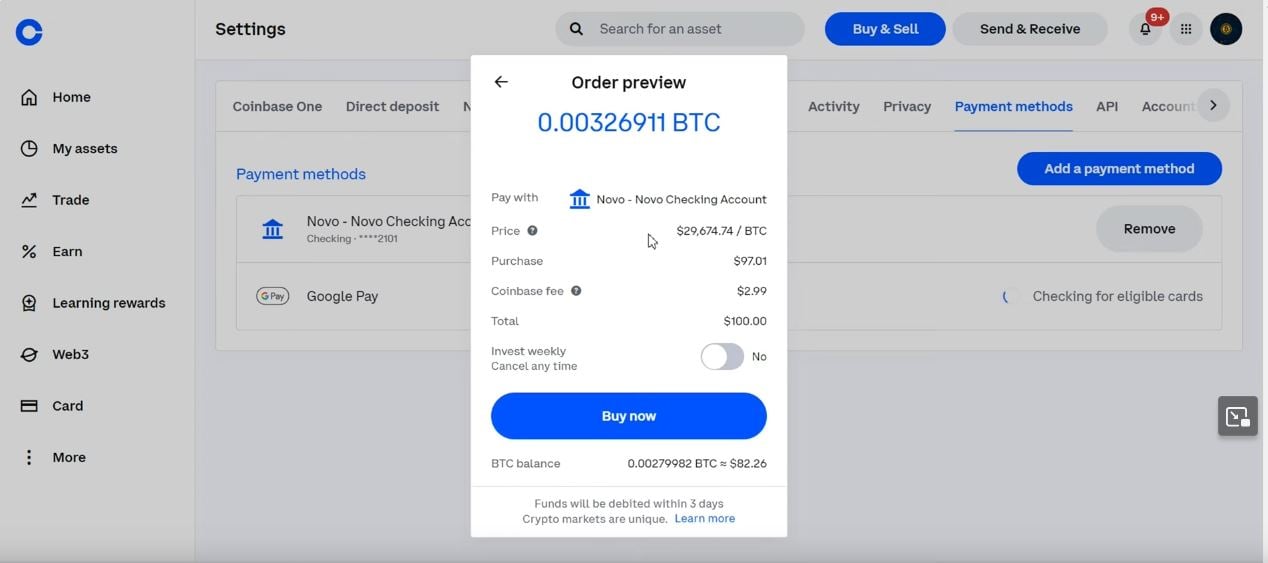

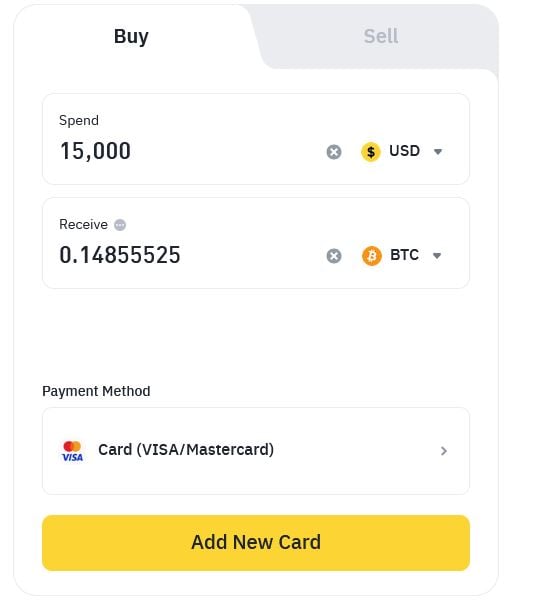

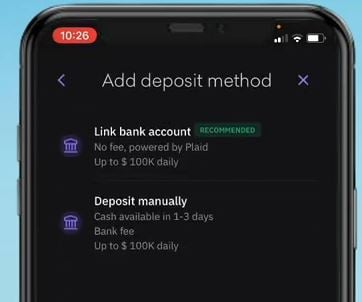

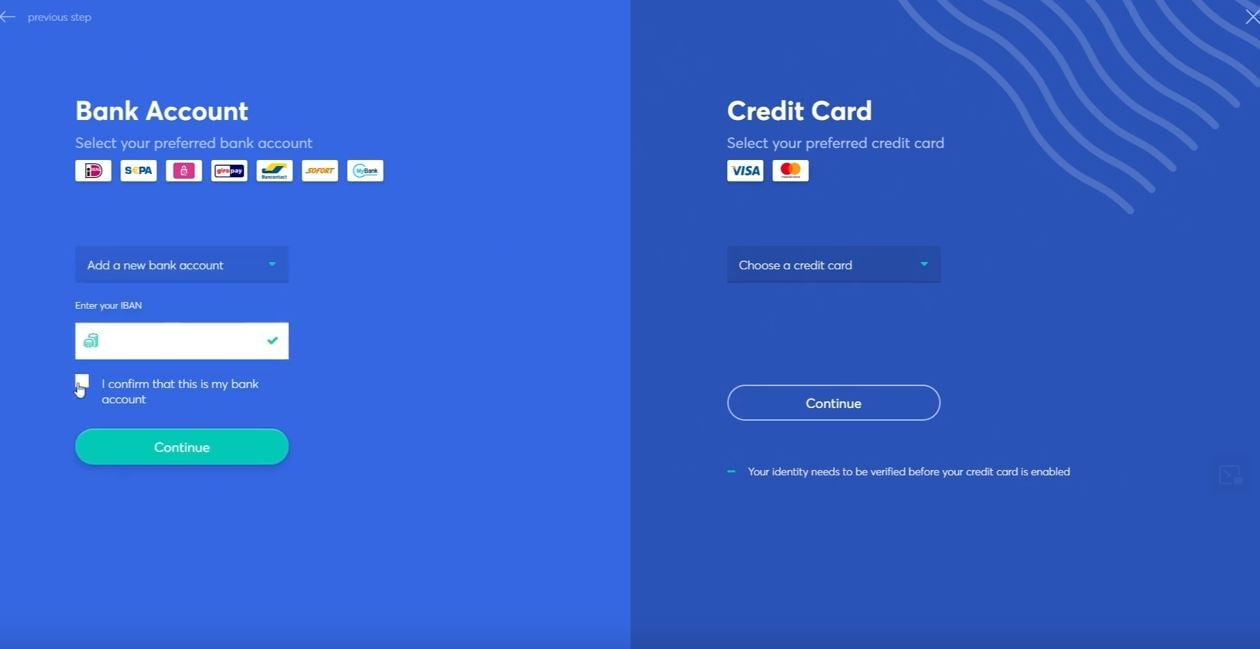

Coinbase enables multiple deposit types like ACH transfers (no fee), wire transfers ($10 fee), debit cards (3.99% fee), and PayPal (2.5% fee).

Fees vary depending on trade size on Coinbase Advanced:

-

For $1,000 in trades: 0.60% taker fee ($6), 0.40% maker fee ($4).

-

For $10,000 trades: 0.40% taker fee ($40), 0.25% maker fee ($25).

-

For $100,000 trades: 0.25% taker fee ($250), 0.15% maker fee ($150).

Assistance is available 24/7 through live chat, email, and telephone. While service reviews are mixed, Coinbase has addressed incidents rapidly with no major customer losses on record.

Below you’ll find a summary table with the most relevant details:

|

Factor

|

Quick info

|

|

License

|

US money transmitter, in S&P 500 since 2025

|

|

Fees

|

0,15%

|

|

Costs per $10.000

|

$15,00

|

|

Support

|

24/7 hotline & chat

|

|

Security

|

≈ 98% in cold storage.

|

|

KYC Process & Limits

|

Video verification < 10 min

|

|

Tax & Reporting Tools

|

CSV/API exports, annual tax reports

|

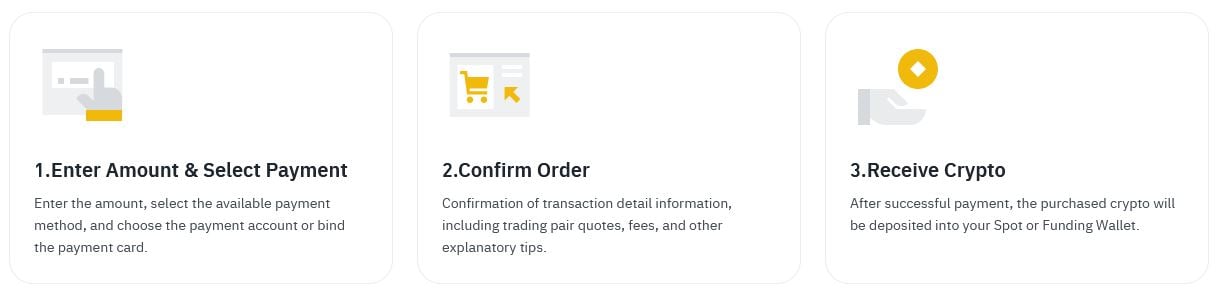

Video Walkthrough: Buying Sui on Coinbase

Advantages of Buying Sui via Coinbase

- Straightforward Interface: The layout is easy to use, even for crypto newcomers.

- Top-Tier Security: Measures like two-factor authentication and insurance for assets stored in the Coinbase Vault are provided.

- Variety of Payment Choices: Multiple payment types—bank, card, PayPal—are accepted for maximum flexibility.

Buy Sui on Binance

Important Details About Binance

Binance ranks as the world’s leading crypto exchange by trade volume, operating under strong regulatory oversight. It maintains a VASP license in Dubai and is officially registered across the EU, providing oversight by multiple authorities.

For security at an institutional level, Binance uses Ceffu, an independent custodian certified under ISO 27001 and 27701 and SOC 2 Type 2. Funds can be stored offline with MPC key sharding, while real-time monitoring enhances protection.

Client funds are secured via the Secure Asset Fund for Users (SAFU), valued at about $1 billion, and by monthly Merkle-tree Proof-of-Reserves, with over $58 billion in Bitcoin backing it. Multiple authentication steps are required for withdrawals, and resets temporarily restrict withdrawals for safety.

Withdrawals are processed rapidly, and trading fees are highly competitive at 0.10% (or 0.075% if fees are paid with BNB), making Binance a cost-efficient choice.

With round-the-clock live support and a design suitable for beginners and professionals, Binance offers a secure, low-fee, and adaptable platform for both trading and storing Sui and other assets.

See the overview table for key points:

|

Factor

|

Quick info

|

|

License

|

US money transmitter

|

|

Fees

|

0,10%

|

|

Costs per $10.000

|

$10,00

|

|

Support

|

24/7 hotline & chat

|

|

Security

|

≈ 90% in cold storage.

|

|

KYC Process & Limits

|

Video verification < 60 min

|

|

Tax & Reporting Tools

|

CSV/API exports, annual tax reports

|

Binance Video Guide: Buying Sui

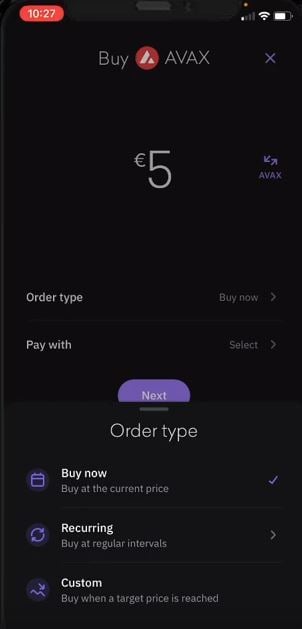

Extra Tips for Sui Trading

- Margin Trading: Binance supports leverage trading for experienced users, offering opportunities for larger gains (and risks). Make sure to understand all risks before using leverage.

- Account Security: Activate 2FA for maximum protection. Binance offers robust safety tools, cold storage, and an insurance fund for major incidents.

Buy Sui on Kraken

What You Should Know About Kraken

Kraken operates under a broad set of international regulatory approvals, including FinCEN Money Services Business and Wyoming SPDI status in the U.S., is registered as a Restricted Dealer in Canada, authorized by the FCA in the U.K., holds Irish EMI and VASP registrations across the EEA, is a DCE under AUSTRAC in Australia, and classified as a Class F Digital Asset Business in Bermuda.

Roughly 95% of client holdings are secured in multi-signature cold wallets that are air-gapped, regularly validated by independent proof-of-reserves checks. Most users complete intermediate KYC (ID, selfie, address) in 15–30 minutes; some manual verifications may need up to 24 hours.

Funding options include free SEPA, FPS, ACH, and Fedwire transfers; SWIFT costs $3–5; PayPal is free; card purchases are 3.75% plus €0.25; crypto deposits have no charge. Withdrawal fees are similarly competitive, and crypto withdrawals typically match network costs. Sui withdrawals may benefit from network-specific advantages for small amounts.

Kraken Pro users start with maker/taker fees of 0.25%/0.40%. For taker trades, expect $4, $40, and $400 fees for $1,000, $10,000, and $100,000 orders, respectively; monthly trading above $50,000 drops the $100,000 fee to $240.

24/7 customer service is offered by live chat, phone, and support tickets. Most chat responses come within five minutes; emails can experience delays during busy times.

Kraken has never experienced a breach of customer assets: in 2024, a zero-day incident allowed researchers to extract $3 million (fully recovered), and attempted social engineering in 2025 was blocked before any losses.

See the table below for a summary of the main details:

|

Factor

|

Quick info

|

|

License

|

US money transmitter and worldwide licences

|

|

Fees

|

0,16%

|

|

Costs per $10.000

|

$16,00

|

|

Support

|

24/7 hotline & chat

|

|

Security

|

≈ 90% in cold storage.

|

|

KYC Process & Limits

|

Video verification < 120 min

|

|

Tax & Reporting Tools

|

CSV/API exports, annual tax reports

|

Video Tutorial: Buy Sui on Kraken Step by Step

Why Use KuCoin for Sui?

- Simple User Experience: KuCoin’s platform is easy for everyone—from first-timers to pros.

- Advanced Security: With features like 2FA, withdrawal whitelists, and anti-phishing protection, your Sui is safeguarded.

- Low, Flat Fees: Trading fees start at just 0.10% and can be reduced even further by paying with KCS or reaching higher VIP tiers.

- Diverse Funding Options: KuCoin supports over 70 payment types globally, including cards, transfers, and local gateways, to suit every user.

Buy Sui on OKX

Essential Information About OKX

OKX is based in Seychelles and operates under full regulatory compliance in Europe through its crypto-service-provider registration with De Nederlandsche Bank (DNB). In January 2025, OKX secured a complete Markets-in-Crypto-Assets (MiCA) license, granting seamless service to all 28 EEA countries via its Malta location.

In the United States, OKX resolved an unlicensed operation case in February 2025 by paying $504 million in penalties and appointing an independent compliance monitor through 2027. In April 2025, OKX launched a separate U.S. platform, but does not possess federal or state MSB/MTL licenses.

Each month, OKX discloses Proof-of-Reserves statements that consistently confirm over 100% asset coverage (March 2025: 105% BTC, 103% ETH, 101% USDT, 101% USDC), with May 2025 reports verifying $28 billion in core assets.

Basic KYC (ID and selfie) is automatically validated within 30 seconds and typically never exceeds 24 hours; advanced verification might take up to two working days during peak times.

Sui and other crypto deposits are free. EUR SEPA transfers come with no OKX fee (bank fees may apply); iDEAL and Bancontact are also free. Card transactions via Simplex or Banxa add roughly 3.5% (minimum $10).

Spot trading starts at a 0.14% maker / 0.23% taker fee: orders of $1,000 cost $1.40 / $2.30, $10,000 cost $14 / $23, and $100,000 cost $140 / $230. OKB token holders can receive up to a 40% fee reduction.

OKX provides 24/7 customer support via live chat and ticket system, with average response times below 15 minutes. However, external reviews currently average 2.7 / 5.

Between October and November 2020, OKX briefly suspended withdrawals during a police investigation. All assets were later released, and no user lost funds.

The table below offers a concise summary of these key features:

|

Factor

|

Quick info

|

|

License

|

US money transmitter and worldwide licences

|

|

Fees

|

1%

|

|

Costs per $10.000

|

$100,00

|

|

Support

|

24h Hotline & Chat

|

|

Security

|

≈ 50% in cold storage.

|

|

KYC Process & Limits

|

Video verification < 120 min

|

|

Tax & Reporting Tools

|

CSV/API exports, annual tax reports

|

Step-by-step video tutorial for purchasing Sui on OKX

Why Buy Sui on OKX?

- Accessible for All: OKX’s platform is intuitive on both desktop and mobile, suitable for every user type.

- Top Security Features: Multi-sig cold wallets, transparent Proof-of-Reserves, 2FA, and anti-phishing codes help protect your holdings.

- Low and Flexible Fees: Trading starts at just 0.14% / 0.23%, with significant discounts for OKB token holders and higher tier users.

- Global Payment Choices: Over 100 fiat on-ramps, including SEPA, Pix, cards, and P2P rails, to match your needs wherever you are.

Buy Sui on Anycoin

Highlights of Anycoin

Licensing – Phoenix Payments B.V. is a registered Virtual Asset Service Provider with De Nederlandsche Bank (DNB) and is also listed with the Austrian FMA and Germany’s BaFin. Anycoin does not offer services to U.S. users and blocks access from U.S. IPs.

Custody – Customer tokens are kept in segregated, hardware-backed cold storage through the “Anycoin Vault,” and transparent proof-of-reserves is published in real-time.

KYC – Digital identity and selfie verification is typically completed within one business hour; outside office hours, it’s processed the next business day.

Funding – EUR deposits by SEPA, iDEAL, and Bancontact are free; Sofort, Giropay, or EPS cost roughly 1%; PayPal transactions are about 1.5%; Visa/Mastercard purchases are around 2.5% + €0.25. Crypto transfers are free apart from blockchain network fees.

Trading Fees – Anycoin applies a flat 1% service charge on all trades (2% for especially volatile assets). As a result, buying $1,000 costs $10, $10,000 costs $100, and $100,000 costs $1,000. Blockchain withdrawal fees are simply passed on at cost.

Customer Support – 24/7 support via live chat, email, and phone, with a Trustpilot score averaging 4.4/5 and typical live-chat response under five minutes, though email replies may take longer during peak periods.

Security Record – Since its founding in 2013, Anycoin has never suffered a hack or customer fund loss.

Below you’ll find a summary table covering the platform’s most relevant details:

|

Factor

|

Quick info

|

|

License

|

US money transmitter and worldwide licences

|

|

Fees

|

1%

|

|

Costs per $10.000

|

$100,00

|

|

Support

|

12h Hotline & Chat

|

|

Security

|

≈ 50% in cold storage.

|

|

KYC Process & Limits

|

Video verification < 20 min

|

|

Tax & Reporting Tools

|

CSV/API exports, annual tax reports

|

Step-by-step video guide: Buying Sui on Anycoin

Advantages of Anycoin for Sui:

- Beginner-Friendly: Anycoin’s streamlined design lets anyone buy and manage Sui with ease.

- High Security: Strong measures, including 2FA and encryption, protect your funds at every step.

- Diverse Crypto Selection: Easily purchase Sui and a range of major tokens through the platform.

- Low Fees: Enjoy straightforward, competitive pricing on all transactions.

- Fast Processing: Anycoin delivers rapid order execution, so your Sui arrives quickly.

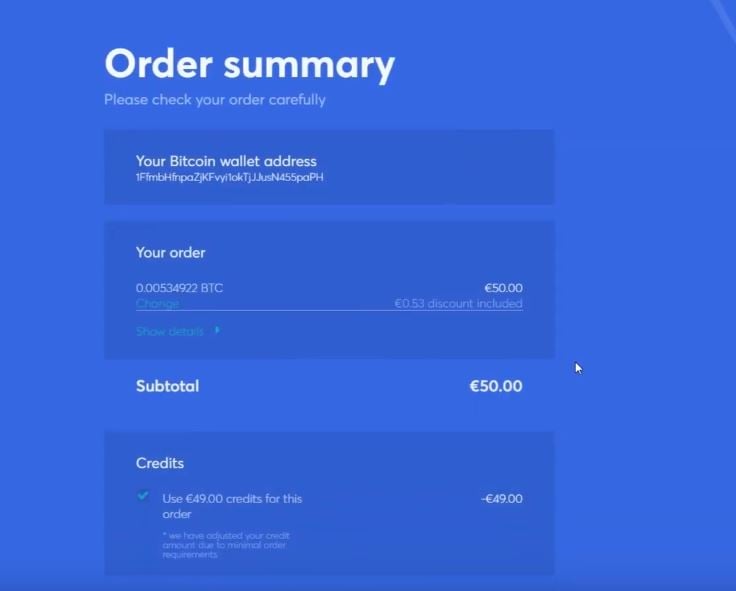

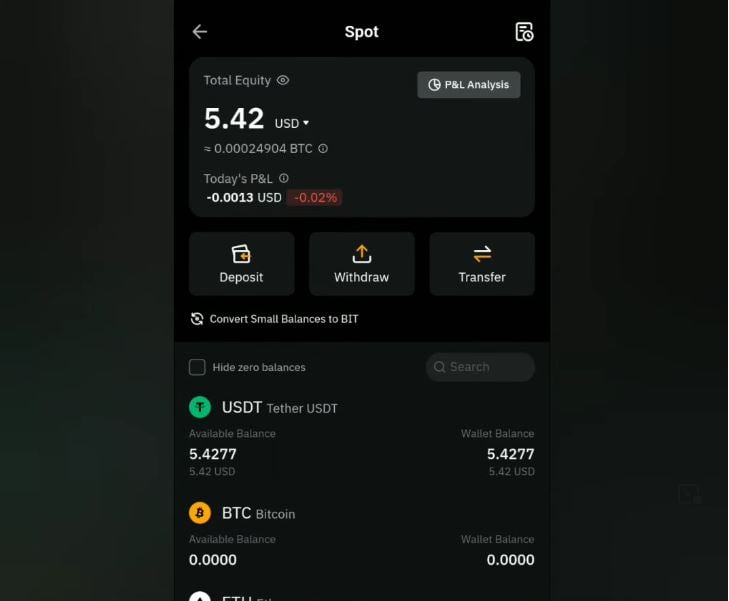

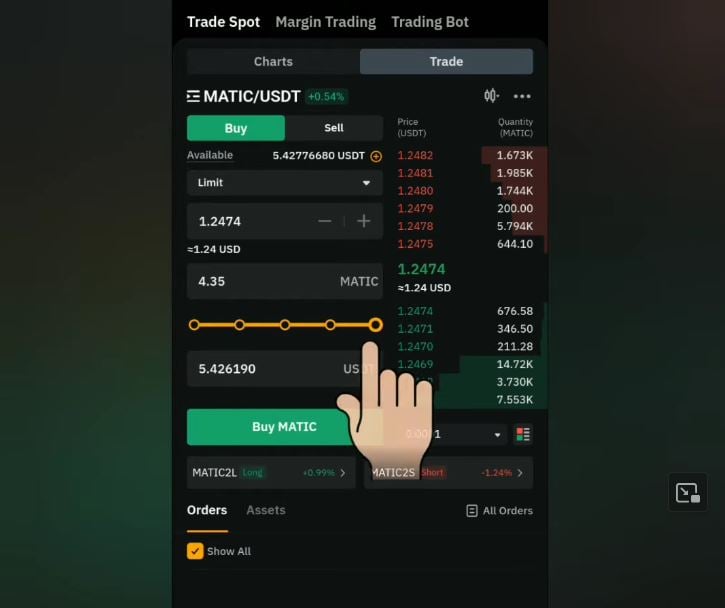

Buy Sui on Bybit

Key Features of Bybit

Bybit operates under the oversight of Dubai’s Virtual Assets Regulatory Authority (VARA) and holds a provisional MVP licence, authorizing it to offer custody and exchange services in the UAE. The platform also has a Crypto-Asset Provider licence in Cyprus, covering the entire EEA. Bybit is not licensed in the United States and geo-blocks U.S. users from accessing its services.

Sui and other client assets are safeguarded in an offline, multi-signature cold wallet architecture, with only minimal hot wallet balances for withdrawals. Bybit regularly discloses wallet addresses and provides 100% Proof-of-Reserves attestations. Standard KYC (photo ID and selfie) usually completes in 15–30 minutes, seldom exceeding 24 hours.

Funding options include: crypto deposits (free), SEPA or Faster Payments via open-banking partners (0–1% fee), credit/debit cards via Banxa, MoonPay, or Simplex (1.1–3.5% plus spread), and a zero-fee peer-to-peer fiat marketplace for direct local transactions.

Spot trading on Sui starts at 0.10% for both maker and taker trades for standard accounts. For reference: a $1,000 Sui trade costs $1.00, $10,000 costs $10, and $100,000 costs $100. Higher volume and VIP-level traders can reduce fees to 0.06%/0.075%. bybit.com

Customer support is available 24/7 via live chat, ticket, and Telegram, typically answering in less than five minutes and resolving most queries efficiently. On February 21, 2025, Bybit experienced a phishing-related cold-wallet incident involving approximately $1.4 billion in ETH; the exchange pledged full restitution and has since enhanced its security framework.

Here is a summary of the key information presented in the table below:

|

Factor

|

Quick info

|

|

License

|

US money transmitter and worldwide licences

|

|

Fees

|

1%

|

|

Costs per $10.000

|

$100,00

|

|

Support

|

24h Hotline & Chat

|

|

Security

|

≈ 50% in cold storage.

|

|

KYC Process & Limits

|

Video verification < 120 min

|

|

Tax & Reporting Tools

|

CSV/API exports, annual tax reports

|

Video Guide: Buying Sui on Bybit

Advantages of Using Bybit for Sui:

- Professional Trading Tools: Bybit provides advanced order types, margin, and leverage options for experienced traders, alongside a broad asset range.

- High-Speed Execution and Deep Liquidity: Orders are filled rapidly, with deep markets for popular coins like Sui.

- Security First: Features include cold storage, insurance funds, and mandatory 2FA for withdrawals.

- Mobile Access: Use Bybit’s mobile apps to manage trades and your portfolio on the go.

- Transparent Fees: Competitive, clear fees make trading cost-effective for all users.

- 24/7 Customer Service: Reach expert support any time through live chat, tickets, or Telegram.